6 Tips for Funding College

I remember looking at my first semester bill and wondering how I was going to make it through college. Federal student loans only covered a fraction of the cost and the interest rate on private loans would have me paying them for the rest of my working life. It was a terrifying moment, wondering if the education I was working so hard to get would actually be sustainable. After that first year though, I was able to get through college largely debt free. Below are 6 pieces of advice on how I was able to do so.

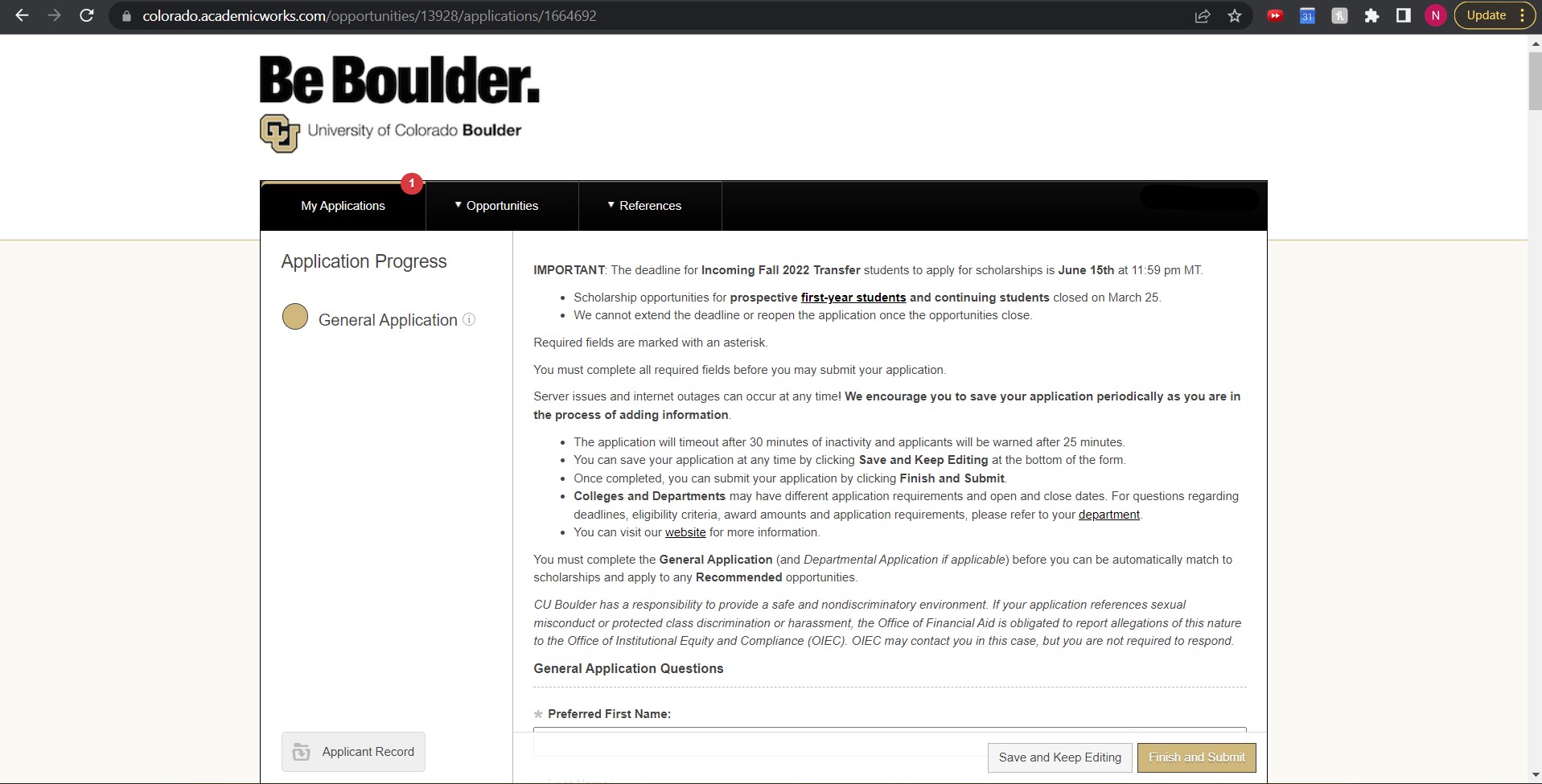

My first word of advice is do not stop applying for scholarships after you get into college. Most universities have scholarship boards and larger scholarships you are not eligible for until you get accepted, start college, or even until you are an upperclassmen! I covered most of my tuition my sophomore through senior year with these sorts of scholarships. After you complete a year and show that you can succeed in university, people and foundations are more willing to give you money. Keep an eye out for those and check with your advisor to see what scholarship sites or boards your school has (Below is an example of University of Colorado Boulder’s)! February is when most of them are typically due, so make sure to have an idea of what you need to do before winter break!

Look at super local scholarships. I mean, literally search “scholarships for Pueblo graduates” or Colorado graduates going to XYZ location. There are a ton of specific scholarships that are less commonly applied for that are made for you! This is especially applicable if you plan to stay in state for college. Check out alumni chapters for your university and see if they have anything set up for where you are from!

The more difficult the application, the less people that apply. I realize this is the last thing that most college students want to hear, but if a scholarship has a 3 page paper form you have to fill out and physically mail in with printed essays, most people will not go through all those steps. Take the time to apply for those since your chances are greater.

Smaller scholarships are worth your time. If you only spend your time applying for the more competitive $10,000 or full ride scholarships, you are missing out on again, lesser applied to scholarships. Small scholarships add up quickly and can greatly ease your burden. You already have most of the information together that you need for each. You can just adjust your content to tailor your application for each new scholarship.

See what sort of fellowships, work study, or working scholarships your college or university provides. Mine offered scholarships to students who worked on campus for more than a year, positions that were paid with a scholarship like being a residential advisor, and other ways to more directly fund your education. These opportunities also look good on resumes!

This last piece of advice may seem obvious but it is important. Don’t forget to reapply to your yearly scholarships. Put notifications in your calendar to make sure you get those in early. If you got the scholarship once, you can probably get it again if you put the effort in.

Funding college can be scary. Even with all this work, you can still end up having to take out large loans. My hope is that maybe this will give you one more place to look to try and cut that down. Your first bill does not have to be the total you pay every semester; it can always get better.

Keep in touch! Subscribe to the SSF Newsletter today for news and updates!

Have any questions you'd like to ask, requests for articles, or feedback? Email us at help@sebsscholarship.org.

Written by Natalie Anderson on Jun 05, 2022